Exciting news in the Canadian market a few days ago. Google announced they would offer Canadian small businesses (SMBs) a free website and .CA domain name via a program called Canada Get Your Business Online.

Excerpts from the release:

Excerpts from the release:

To help Canadian small businesses overcome the obstacles that are preventing them from getting online and fuelling Canada’s digital economy, Google is launching a new program called Canada Get Your Business Online that will provide free websites with a .ca domain, and free advice for businesses across Canada. (…) Google estimates that at least 1.2 million Canadian small businesses don’t have websites. (…) To learn more about the Canada Get Your Business Online program visit www.gybo.ca.

Google understands that if small merchants don’t have a website, they can’t really buy AdWords, Google’s core pay-for-performance advertising model. I thought to myself, what a great idea! An entry website is a commodity. By bundling it with a domain name and offering everything for free, you lock-in the small business advertiser and you are able to upsell them AdWords and Google Tags. For this purpose, they partnered with Yola, a free website-building technology provider.

In productizing Needium, I’ve been exploring entry-level website solutions in the last few weeks. We’ve found that SMBs who have a website perform better in social media. The site serves as the permanent anchor, where all your business information resides and where consumers coming from social media can read more about you and evaluate if you’re “real” or not.

It is with great hope I started creating a test Website on www.gybo.ca but I quickly became disenchanted.

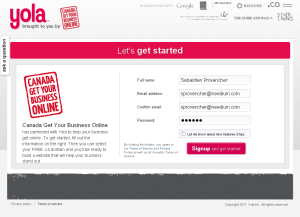

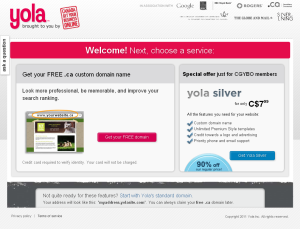

After creating an account, you get to a page that offers you to register your free .ca domain name.

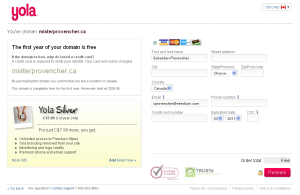

I went through the various steps to find an available domain name and you eventually get to a registration screen that asks you for credit card information “required to verify your identity”. That makes sense.

I was really surprised to read the following fine print on the page though: “This domain is completely free for the first year. Renewals start at C$38.95”.

Hmmmm… .CA domain names are usually $15 per year. That renewal price seems extremely expensive. Maybe you can register free the domain name and eventually transfer it to a cheaper domain name registrar? In the terms, Yola adds “Free .ca and .co.uk domains awarded through our Google partnership are not eligible for transfer or pointing.”

So, it looks like your “free” domain name is really just free the first year and it’s not transferable. Doesn’t sound like a good deal anymore, does it? This really disappointed me. I thought Google had made a move to really change the Canadian SMB landscape by offering a permanently free intro website and domain name. After all, they’ve made other game changing moves in the past and I was expecting the same. But not this time. So, caveat emptor.